1. General guidelines and principles

1.1 The procedures that follow must be read in association with the Staff Gifts and Benefits – Operational Policy and relevant directives and procedures contained in the University’s Financial Management Practices Manual.

1.2 The University and its staff are placed in a position of trust and should act in ways which maintain public confidence in the University. Consequently, it is not appropriate for staff to be offered, to accept, or to give gifts and benefits that affect, may be likely to affect, or could reasonably be perceived to affect, the performance of their duties.

1.3 It is important that conflict of interest situations, once recognised, are declared and resolved in a way which promotes propriety and integrity.

1.4 Consequently a staff member facing a conflict of interest situation (whether actual, potential or perceived) must notify their supervisor. Merely declaring the conflict situation without taking steps to resolve the situation will almost always be insufficient.

1.5 Staff members in sensitive roles (such as purchasing or internal audit) should refuse all gifts to avoid perceptions of bias and remove any conscious or unconscious favouritism.

1.6 A gift or benefit should not be accepted if the purpose is to obtain favours from the recipient or intended to create some obligation.

2. Types of gifts and benefits

2.1 What are gifts and benefits

2.1.1 Gifts and benefits are defined in the associated policy as the transfer of property or other benefit, without recompense; or for a consideration substantially less than full consideration; or a loan of property made on a permanent, or an indefinite, basis; received or given by a staff member when they are acting in their official capacity. Gifts and benefits can be tangible or non-tangible as also defined in the associated policy.

2.1.2 There are two levels of gifts or benefits:

(a) Nominal gifts or benefits (Fair market value of less than $150)

- Entertainment

- Hospitality

- Bottle of wine

- Flowers

- Chocolate

(b) Reportable gifts or benefits (Fair market value of $150 or more)

- Computer

- VIP tickets

- Ornament

- Artwork

2.1.3 Where a staff member or the University receives more than one gift from the same donor or gives more than one gift to the same recipient in a financial year (1 January to 31 December), and the current market value of all gifts is $150 or more, then all the gifts are considered to be reportable gifts.

2.2 Determining fair market value

Staff should ensure they have appropriately researched and validated the estimated value of any gift or benefit. Deliberately or negligently providing an undervalued amount to avoid reporting or to fraudulently keep an item is considered misconduct. If there is difficulty establishing the value, contact the Director, Governance and Risk Management who will consult with the Chief Financial Officer.

3. Receiving Gifts

3.1 Refer to Appendix B and Appendix C for information regarding receiving gifts.

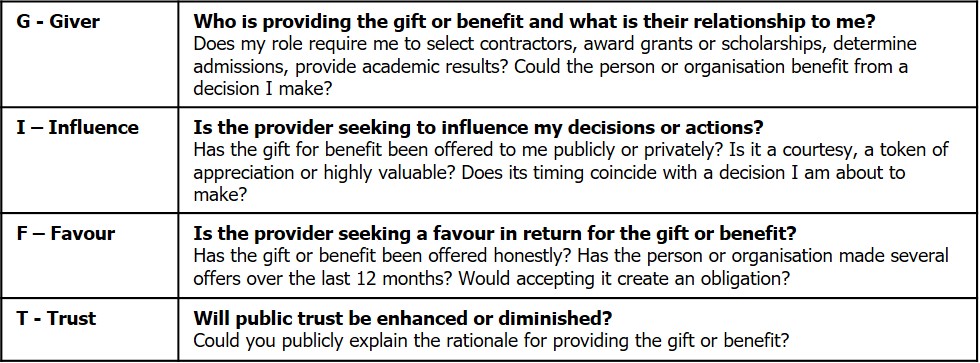

3.2 Prior to accepting any gift, staff members should implement the GIFT approach and act in accordance with the Policy and Procedures. If in doubt, contact your Supervisor or Governance and Risk Management.

(Corruption and Crime Commission, Office of the Information Commissioner, Office of the Auditor General, Public Sector Commission, and Office of the Parliamentary Commissioner for Administrative Investigations 2016).

3.3 Nominal gifts or benefits

3.3.1 A staff member may accept an occasional gift of nominal value which is offered in accordance with social or cultural practice, for instance, when a staff member retires or leaves the University or visits another University overseas.

3.3.2 Any nominal gift or benefit received by a staff member may remain the property of the staff member provided acceptance is not likely to affect, or could reasonably be perceived to affect, the independent and impartial performance of the staff member’s official duties. Staff members must notify their Supervisor in writing of any nominal gift received.

3.4 Reportable gifts or benefits

3.4.1 All reportable gifts or benefits must be recorded in the gifts and benefits register. Staff must notify Governance and Risk Management of a gift received by filling out the Declaration form in Appendix A within 14 days of receipt. In the case of a reportable gift received during overseas travel, a declaration must be submitted within 14 days of the recipient’s return to the University.

3.4.2 Reportable gifts are considered the property of the University. The Declaration form requires approval by a Supervisor or Senior Staff Member to retain the gift.

3.4.3 For reportable gifts with a value between $150 - $350, Supervisor approval is required to retain the gift. For gifts or benefits over the value of $350 approval by a member of Senior Staff is required to retain the gift. For Senior Staff, approval by the relevant Executive Member is required to retain the gift, and for Executive Members, the approval authority is the Vice-Chancellor and President. The Chancellor is the approval authority for gifts retained by the Vice-Chancellor and President.

3.4.4 In all cases, gifts of cultural or historical value must remain the property of the University and cannot be purchased by a staff member.

3.4.5 In respect to the provision of speaking services at a conference by a staff member, it is possible that a significant gift may be received as a gesture of thanks or in lieu of speaker fees. Under such circumstances, GST consequences may arise and therefore specific advice should be obtained from the Chief Financial Officer.

3.5 Cash gifts or benefits

3.5.1 Any cash item, such as money, or any items easily converted to cash (e.g. loan, voucher, “scratchies”, shares or lottery ticket) must be refused, regardless of value.

3.5.2 In exceptional circumstances, such as an award which involves a cash prize, express approval must be obtained from the relevant member of Executive, for an employee to accept such a gift, subject to the other provisions of the associated policy and these procedures. This includes consideration of the appropriateness of the accepting the gift and the requirement to report the gift for inclusion in the gifts and benefits register.

4. Provision of Gifts

4.1 In certain cases, it may be appropriate for staff to provide gifts to individuals or organisations on behalf of the University. Examples of such cases may include:

- presentation to sponsors of events

- presentation to artists in appreciation of their work

- presentation to overseas dignitaries or delegations visiting the University

- presentation by staff when travelling overseas on official University business

4.2 The practice of giving gifts should not be common or frequent in occurrence.

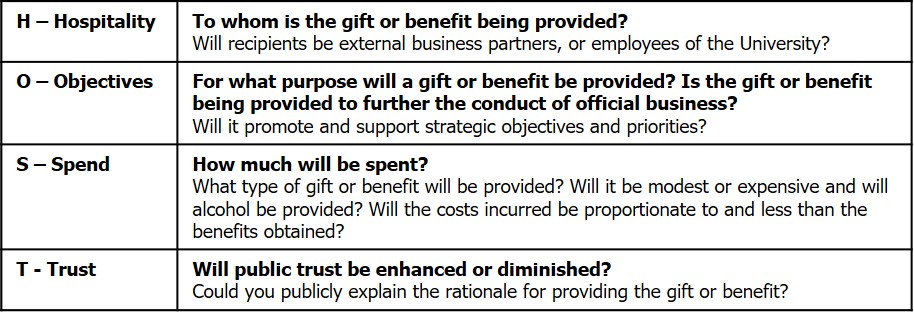

4.3 In deciding whether to provide gifts or benefits, consider the policy and procedures and conduct the HOST test. If in doubt, contact your Supervisor or Governance and Risk Management.

(Corruption and Crime Commission, Office of the Information Commissioner, Office of the Auditor General, Public Sector Commission, and Office of the Parliamentary Commissioner for Administrative Investigations 2016).

4.4 The provision of hospitality or entertainment should be managed in accordance with the Hospitality – Operational Policy and associated procedures.

4.5 All gifts given on the behalf of the University that are of the value of $150 or more must be reported through the Declaration in Appendix A, to be recorded in the gifts and benefits register.

Appendix A

Staff Gifts and Benefits Declaration Form

(For gifts received by Employee with a value of $150 or more, or gifts given by the University that are of the value of $150 or more)

Staff access only via MyUniSC – Appendix A

Appendix B - quick guide to receiving gifts

Staff access only via MyUniSC – Appendix B

Appendix C: Receiving Gifts – Decision Tree

Staff access only via MyUniSC – Appendix C

END